By:

Faith

L. Morlu

Abstract

The

world observed the deadliest financial crisis since the great depression of the

1930s in 2008. The signs of a financial crisis started becoming visible in the mid-2007

and early 2008 by the demise of stock markets, the failures of big financial

institutions in the United States and parts of Europe. Given that banks play a

key role in our modern market system due to globalization, the crisis quickly

swelled through the whole real economy,which turned a financial crisis of the

United States into a global economic crisis. The crisis affected many regions

of the world in different ways due to their diverse interaction with the United

States. In this paper, I examined the effect of the crisis in Africa more

precisely Ghana and South Africa. The impact was analyzed with regards to the

performance of Gross Domestic Product, Balance of Payments, Fiscal Deficits,

Net Investment Levels, Inflation indices and the Trade statistics of the both

countries.

1. The great recession of 2007

1.1 Background to the Crisis

The

years preceding 2007 are often been referred to by economists as the years of the Great Moderation, since these were

years advanced economies witnessed stable growth rate, and vast macroeconomic stability. In 2001 the US

Fed lowered the interest (The Fed fund rate) rate from 6.5% to a drooling 1.75%

(Singh, 2011). Thus creating a flood

of liquidity in the economy. Bankers and reckless borrowers who didn’t have a

permanent income or job came seeking credits due to the overflowing of cheap

money. These so-called subprime borrowers came for these loans with the minds

of achieving their dreams of owning a home. So, as subprime borrowers

increased, so did the prices of homes. This new development made Investment in questionable subprime mortgages seem like a new gold mine.

In

2003 the Fed brought interest rate down to 1%, thus leading to bankers

repackaging mortgages into Collateral Debt obligations (CDOs) and selling them

off. Subsequently leading to the development of a large subordinate market for

the distribution of subprime loans. And then the Security Exchange commission

of the US went on minimizing the Net Capital Requirement of the five big

investment banks in 2004. Thus making these investment banks to Leverage 30 or

40 times their original investments.

1.2 The Crisis

As

of June 2004, the Fed started immensely raising interest rates so much that by

June 2006 interest rates had peaked 5.25%.(IMF,

2009)This vastly increased in interest rates led to the start of borrowers defaulting

on their loans, causing a bad start of the year 2007 with so many subprime

lenders claiming bankruptcy. According to Singh (Singh, 2011), hedge funds and some financial firms held more than

1 trillion in securities that were backed by these failing subprime mortgages,making

the situation alarming enough to start a global financial crisis if more and

more borrowers kept defaulting.

August

2007 came with the clarity that the subprime crisis could not be solved single

handed by the US financial markets, and soon the crisis started spreading

beyond the borders of the US. Then came the freezing of the inter-bank markets,due

to the speculations among other banks. The Fed came into the situation by the

slashing of the Fed funds rate as well as the discount rate in an effort to

solve the problem, but the worst kept happening. The worst started by the filing of bankruptcy

by Lehman Brothers, followed by

collapsing of Indymac bank, the acquisition of Bear Stearns by JP Morgan

Chase, the selling of Merrill Lynch to Bank of America, and the US Federal

government controlling of Fannie Mae and Freddie Mac.

By

October 2008, the cross border spillover had deepened in many regions of the

world due to inter-linkage of markets and financial institutions with the high

correlation of risks. During which time the US Fed reduced the funds and discount

rates to 1% and 1.75%. Bigger economies Central Banks like China, England,

Canada, Switzerland, Sweden, and the European Central bank took measures to

help the global economy from further crashing by cutting down their rates. But

the cutting down of rates alone was insufficient to halt such extensive global

financial collapse.

2 The Impact of the crisis on Africa

2.1 Africa Before the Crisis

Granted

that Africa is indeed a diverse region and that, not necessarily all economies

have coped well. But prior to the 2007 recession, Africa economies were

generally flourishing, they grew at an average of approximately 6%, inflation

collapsed into a single digit level below 5%. This was before the food and fuel

price shock of 2008 (IMF, 2009).These

positive growth was attributed to the favorability of the external environment,

strong macroeconomic policies, the rise in commodity prices from 2002-2007, and

the massive inflows of grant/AIDS and debt reliefs from the international

community.

Figure

1.SSA

GDP and Exports growth in percentage before the Crisis

Source:

IMF data, Author’s accumulation

The

graph portrays that the region experience economic growth at an average of 6.5%

per year amid 2002 and 2007. The increase in the demand for Africa primary

commodities such as natural resources, particularly oil and minerals was a key

drive to the growth of the continent between these periods. This excess demand

was encouragedby the growth in industrialized countries and the rise of

emerging market economies

like china and India. Granted that

Africa growth during that period was driven by commodity boom, but many other

factors such as; increase in FDI, Net private capital flow, portfolio flows,

remittances, was anticipated to have expanded between the years.(UNCTAD, 2009) In many other African countries, there was an

increase in productivity and domestic demand in terms of telecommunications, as

the use of mobile phone and internet services grew from 2002-2008. All these

trends were aided by enhanced economic governance, fiscal restraint, efficient

banking policies, International debt relief programs, and the decline in the

number of civil war and insurgences made the continent quite striking for

foreign investments.

2.2 Impact of the Crisis on Africa

The

recession that started in the US financial markets was a bit slower in

affecting African economies, but it gradually did. Right after the fuel and

food price shock of 2008, the hard sustained economic gains that Africa had managed

to sustain over the years were at risk. Just as in other parts of the world,

Africa started experiencing the waves of the financial crisis in 2009. The

continent saw a great decrease in the demand of its export, decrease in

commodity prices, and the flow of remittances to the continent also started

declining. As the situation got at its height, International trade got more

costly, foreign direct investors got frightened leading to a fall in FDI, and a

tighter international investor and credit risk aversion led to the reversal of

portfolio flows. Even fragile states like Liberia, Guinea-Bissau and Burundi

whose social and political situation at the time were vulnerable, felt the

impact of the crisis due to their dependence on concessional financing. (Bourdin, 2009)

Figure 2. Percentage of SSA Real GDP, Exports, Imports and Current Account Balance\

Source:

IMF data, Author’s accumulation

Granting

that Africa is the least assimilated region in the world in terms of global

trade, but it was unable to drift away from the effect of the global economic

crisis. Despite the continent low contribution of approximately 2% to global

trade, but the majority of its economies depend on the exportof their primary

commodities for survival. Figure 2 shows a decline from 5.4% in 2008 to 1.3% in

2009 in the total real GDP of South Sahara Africa. Imports, which the continent

depends on heavily due to their poor production and manufacturing activities,

fell from 8% in 2008 to -4% in 2009 due to the decline in global productions.

Due to the continent exposure to industrialized economies, there was a decrease

in the demand for African exports leading to exports falling from 8% in 2007 to

-0.071% in 2008, and -5.6% in 2009.

The

IMF data indicates a general fall in Africa's economic growth by nearly4%percentage

in 2009.The mixture of poor export demand, the decline in private capital flows,worse

commodity prices, decrease in remittances, the cutting down in tourism

revenues, and fragile government revenues were all reasons that the continent

economic growth fell by close to four percentage in 2009. The continent

emerging markets or middleincome countries thatwere more assimilated into the global

markets were the hardest hit: with growth slipping by about 4.5% in 2009.But in

the normal course of events, disparities in economic growth across sub-Saharan

Africa areintenselyconnected with eccentricshocks which were also a reason for

the fall in the continent growth. What started with the decline of commodity

prices and in some countries affecting the wages ofthe workforce and even

farmers, quickly led to an exit for a total economic collapse and the

intensification of the class struggle.

1 3 Why Ghana and South Africa?

I

choose Ghana and South Africa because they are both growing economies and

emerging markets in Africa. And these economies with financially developed

markets were the first to feel the effects of the global financial crisis

because they were more assimilated into the global financial market by the

connection of capital flows, exchange rates and stock market investors. Given

that the first four economies that were hit by the crisis in Africa are;

Nigeria, South Africa, Ghana and Kenya, which led to capital flow reversals, a

fall in their equity markets, and exchange rate compression, I decided to analyze

the Ghanaian economy being from the west, and the South African economy being

from the South.

2 Ghana and the Global Financial

Crisis

3.1 Trends before the Crisis

There

have been a lot of changes in the Ghanaian economy since their independence

from the British in 1957. Their economy has gone through so many changes

ranging from the poor economic performance from the 1980s that was marked by

the coup and lack of market principles in the National economic policy. For the

most fact, before the economy started enjoying a period of strong economic

growth, they struggled with the issues of low productivity, high interest

rates, high and volatile prices, and high interest rates thus leading to a very

abnormal growth during those years.These issues lead to many difficulties such

as: limited access to International Credit, reduction in foreign direct

investment, declining exchange rate and International trade.

The

country came back on the track of unprecedented economic growth in the early

1990s, when they took up the multi-party, the neo-liberal project of the IMF

and World Bank, and constitutional rule. This return was marked by an increase

in the prices of the Ghanaian traditional products (Cocoa and Gold) compiled

with a series of market reforms which enable the environment for the growth of

the private sector. With the improvements in both the microeconomics and the

political conditions, the country has been standing firm on the grounds of a

solid economic performance over the past years.

Figure 3.

Ghana growth measure by the percentage change and real GDP and Inflation

Source: IMF data, Author’s accumulation

The

World Bank data show a growth rate of about 5% per year in the Ghanaian economy

over the last 20 years. Within the last few years, the country has been

pursuing a more outward trade policy that recognizes export as a key engine for

economic growth and prosperity. In figure 3, we see that the period after 2003

was a very spectacular one with a GDP growth rate averaging approximately 5.9%

from 2003 to 2007. The proper implementation of macroeconomics policies leads

to Inflation staying below an average of 15% throughout these years of boom.

The

government of Ghana principal objective from 2000 was to reduce its domestic

debts and stabilized the balance in terms of GDP performance. This objective

was realized from 2001-2005as gradual improvement was seen in the overall

performance of the budget balance. But as for fiscal deficits, it was very low

due to the new measure of improvement in revenue expansion, and economic

expansion.

But

with all the improved growth level in the Ghanaian economy, the Current Account

balance did speak an actual different story. Figure 4 indicates a current account deficit that kept growing from

2002 to 2007. Aneconomythat is being run on a current account deficit is due to

the increase in the value of imports of goods, investment, services, than that

of the value of exports. It is sometimes referred to as a trade deficit.

Figure

4.

Inflow of FDI as percentage of GDP and C/A balance as percentage of GDP

Source: IMF & ITC data, Author’s accumulation

And this was the case of Ghana during these years,

Ackah et al, in their 2009 paper reveals that during 2003-2007 imports

increased from $3232.8 million to $8073.57 million. While exports increase just

from $2562.4 million in 2003 to $4194.7 million in 2007. (Ackah et al, 2009)But the issue of low export during these years

cannot only be attributed to the economy huge dependence on primary

commodities. But I can argue that it was attributed to the economy’s heavy

dependence on a constricted range of primary commodities without

diversification, just like other African economies. I argue this because; Ghana

primary commodity in International trade that constitutes approximately 60% of

its exports is largely Cocoa and gold. See figure

5 below.

Figure 5.

Ghana Trade statistics, Imports and Exports as a percentage of GDP over the

years

Source: World’s Bank data, Author’s accumulation

3.2 The

impact of the Crisis

Due

to the country’s past 25 years of aggressive exports led industrialization, and

their enactment of the IMF and World Bank neoliberal policies, they became

significantly integrated into the global economy in terms of international

trade. So they were not spared from the external shocks of the crisis. Figure 5, shows an increase in

Inflation from in 2007 to 16.5% in 2008. This increase can be attributed on

account of the external shocks and the strong domestic demand. Just after a

brief fall, to single-digits in 2006, inflation gallopedin 2007–2008, which

reflected the impact of the global food and fuel price shocks, marking the

beginning of the global financial crisis late 2008. But the graph indicates

that by January-May 2009, inflation did stabilized a bit by 20% percent that is

it dropped from 16.5% in 2008 to 14.5% in 2009.

Figure

6.

Real GDP (annual % change), FDI Inflow (% of GDP), C/A balance (% of GDP)and

Inflation (Annual % change)

Source: IMF & ITC data, Author’s accumulation

The

graph also shows the shifts in the flow of FDI in the economy from 2008-2010.

FDI plays a key role in the Ghanaian economy, by means of capital flows as well

as employment generation. The decrease in FDI was due to the tension on global

capital, by the crisis. This led to a fall in FDI from 9.5% in 2008 to 9.1% in

2009 and it further fell to 7.9% in 2010 (percentage of GDP). The fall in FDI

can also be related to that of the decrease in aid/grants and remittances. As

many of the industrialized nations that grant aids were pressed by the crisis,

the number of aid flow into the economy rapidly decreased from 2007-2009. The

crisis also had an impact on exchange rates. The Ghanaian cedis started

depreciating against all other major currencies as of mid-2008.

As

the global financial crisis brought a fall in the prices of commodities due to

the fall in demand by international companies, the exports of concerned

countries began falling. The bank of Ghana reported a fall in the price of the

country’s main export which is gold in 2009. The price fell from $965.90 in

2008 to $803.91 in 2009. Gold wasn’t the only export that was affected; exports

such as cocoa and other commodity prices as well started declining during the

same period. While there were continuous

poor performance of exports during that period, Imports on the other hand was

increasing due to the export led strategy that made it to produce what was not

consumable and consume what was not produced in the economy. See figure 5.

1 Impact of the crisis on South

Africa

4.1 Trends

before the Crisis

South

Africa has been Africa’s wealthiest major economy for years, (until recently

Nigeria took over) has been a key player in the role of emerging market

economies that have helped transform the global economy over the years. The

South African growth trends started by their political transmission from the

Apartheid regime to the most peaceful political regime in Africa since early

1990s.An intense reformation of the economy did bear a successful fruit in the

form of macro-economic stability, flourishing exports and improvement in productivity

in capital and labor.This transmission came along with vibrant economic growth

that was sustained for almost a decade. The growth was due to the country’s

record of a sustained macroeconomic farsightedness that was added to a

supportive global environment. The country sustained a GDP growth at a stable

pace until the global financial crisis of 2008 and 2009. The sustained GDP

growth was also accompanied by the improvement in fiscal balances, leading to

the decrease in the government gross debts. Due to the sound policies

implemented, the collection of revenue quadrupled and the number of taxpayers

increased fivefold between 1996 and 2007. (World

Bank)

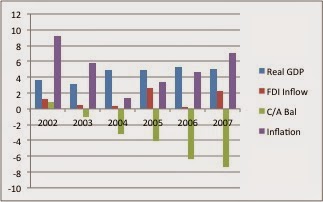

Figure 7.Real

GDP (annual % change), FDI Inflow (% of GDP), C/A balance (% of GDP)and

Inflation (Annual % change)

Figure

7 indicates the growth trend in South Africa from 2002 to 2007. As shown in

figure 7, South Africa's real GDP rose by 3.6% in 2002, 3.1% in 2003, 4.8% in

2004, 4.9% in 2005, 5.3% in 2006, which has been cited as the highest 1981 and

5% in 2007. This growth can be attributed to the effectiveness of thebold

macroeconomic reforms that have enhanced competitiveness, employment creation

and opening South Africa to the multilateral trading system. The country saw

its inflation rate going down from 5.8% in 2003 to 1.3% in 2004 but peak again

in 2005 to 3.3% which was due to the primary increase in food prices. All these trends were driven by household

consumption, private and public fixed investment on the demand side, financial

and business services, construction, and wholesale years and retail trade on

the supply side.

Figure 8.South

Africa Trade statistics, Imports and Exports as a percentage of GDP over the

Source:

World’s Bank data, Author’s accumulation

After

the country’s integration into the global economy, their trading statistics were

subjected to enormous changes as figure 8 rightly portrays. Exports and Imports

of South Africa started an actual boom from 2004 to 2008 given that exports

rose by 26% in 2004, 27% in 2005, 30% in 2006, 31% in 2007 and 36% in 2008.

Imports on the other hand, rose by 7% in 2004, 28% in 2005, 32% in 2006, 34% in

2007 and 30% in 2008. The change in the country’s volume of trade can be

ascribed to those reforms that were mainly concerned with at achieving greater

economic stability and liberalization. These reforms increased the country’s

productivity, favoring trade, and foreign capital flows as never before in the

economy.

4.2 Impact of the crisis on South

Africa

The

crisis made a severe impact on the South African economy, given that the

economy suffered its first recession in 2008/2009 since 17years of economic

growth and development. The year 2009 was marked as the largest slowdown in the

South African economy, and its impact was even larger than that experienced by

some industrialized and emerging economies.The financial crisis was said to

have been transmitted into the economy primarily via the financial markets,

tightening of bank lending standards and trade linkages due to their

integration into the world economy. In South Africa, the financial sector

experienced a failure of asset prices, intense increases in the cost of capital

along with a severe contraction in loaning. Millions became jobless in 2009 as

the result of the crisis. Besides the increase in unemployment, the effect of

the crisis was also seen through the increase in consumer demand and consumer

credit, the fall of imports and exports, and the sad story of net financial

inflows turning into net financial outflow thus resulting in share prices

dropping.

Figure

9.Real

GDP (annual % change), FDI Inflow (% of GDP), C/A balance (% of GDP)and

Inflation (Annual % change)

Source: IMF & ITC data, Author’s accumulation

Source: IMF & ITC data, Author’s accumulation

Figure

9, shows the impact of the crisis on the economy from 2008 to 2010. Real GDP

was seen to drop from 3% in 2008 to -2.1% in 2009. The fall in the real GDP in

2009 was a bit narrower as compared to other emerging markets. The fall was

quite lower because of the South African economy did not experience any major

bank failures or bankruptcy, and the OECD proclaimed this declined to be counterbalanced

by the strong growth in the construction industry and cheap oil prices during

that period. (OECD, 2010) The graph also

shows the impact of the crisis on the inflow of FDI in the economy. FDI fell

from 3.6% in 2008 to 2.7% in 2009 because of the decrease in the level of

confidence of investors. This decrease in the level of confidence of investors

led to foreign portfolio investment flows to other emerging countries to be reversed.

Additionally the impact of an unstable global capital market and a very poor

investment or banking environment placed a downward pressure on the volumes of

business and also had a negative effected on fee income. So investment income further

dropped due to the poor performance of the global equity markets. Subsequently,

the current account balance indicates a decrease in the trade deficit from

-7.4% in 2008 to -4.9% in 2009. Inflation, on the other hand, as portray by the

chart, fell from 11.5 in 2008 to 7.1 in 2009.

Just

as International trade jumped during the global crisis, South African exports

of goods (see figure 8 on pg. 11) and services fell sharply as a result.

According to Kershoff (2009:8-9), South Africa was hit really hard by the drop

in the international demand for vehicles and non-food commodities (industrial

raw materials) mainly because these items dominate the country’s exports. Figure

11 shows a fall in exports from 36% in 2008 to 27% in 2009, and imports also

fell from 39% in 2008 to 28 in 2009.

Another

significant impact on the South African economy was the increased in the rate

of Unemployment. The country had previously been suffering from the issue of

unemployment and this crisis, unemployment only added up and intensified the

existing regional economic inequalities. In mid-2009, South Africa labor force

statistics reveals that there were 7 of the 9 provinces that unemployment rate

had exceeded the national rate of 24.3%,

making it the highest in South Africa poorest provinces with a large rural

population.

1 Conclusion

With

Africa least integration into the global economy, it was hit hard by the global

economic crisis.The continent economic growth went from 5.2 percent in 2008 to

1.6 percent in 2009. Luckily, Africa responded by upholding those good policies

that had brought some level of growth in the past, and they continent started

recovering in 2010.Notwithstanding, with all the many challenges facing the

continent, ranging from an enormous infrastructure deficit,weak initial

conditions for the 2015 Millennium Development Goals,low agricultural

productivity, and a very poor governance,but Africa’s performance has recently

given us cause for optimism.

The

2008 financial crisis was more global than any other period of financial

turmoil since the great depression. The degree and severity of the crisis echoed

a combination of several factors, some of which are common to previous crises

and others are new.In previous financial havoc, the pre-crisis period, was

mainlyconsidered by the surging asset prices proving unsustainable, anextended

credit expansion that led to theincreasein debt, marked by the beginning of new

types of financial instruments and the failure of regulators to keep them up.

The

slowdown in economic activity that came as a result of thegreat recession of

2009, left Ghana and South Africa under immense pressure to build their economy

back to its pre-crisis level.Many Corporations were affected directly through

higher financing costs, as well as secondarily that is through the impact of

the crisis on their customers and, their balance sheets. Exports were under

pressure due to the decline in world trade, and many jobs were lost in some

industries, and in other industries the pressure onwages combined with the

costs of production remained high.Even though all financial criseshas

similarities with previous crises (Great depression, amongst others) in some features,

but the effects or the impact of the global financial crisis of 2009 remains

the worst ever experienced since the great depression and therefore it remains

significantly different.

2.

References:

1.

Ackah,

GodfredChales, Dorku, Bortei Ellen, and Aryeetey, Ernest “Global Financial Crisis Discussion Series: Ghana”, May 2009,

Overseas Development Institute 111 Westminster Bridge Road

3.

Otoo,

KwabenaNyarko, and Adjaye, Prince Asafu“The

effects of the Global economic and Financial crisis on the Ghanian economy and

Labour Market”, Labour Research and Policy institute November, 2009

4.

Paulo, Drummond and Gustavo

Ramirez,“Spillovers from the rest of the

World into Sub Sahara Countries”, IMF working paper 2009

7.

IMF “Regional Economic Outlook, Sub-Shara Africa; Staying the course”

October 2014

(Faith

L. Morlu is a Masters student at Jindal School of International Affairs)